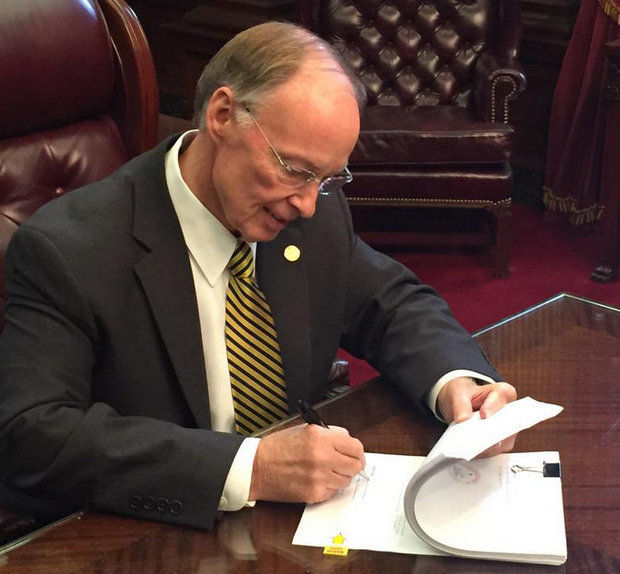

MONTGOMERY, Ala.—After a 6-month stalemate that has spanned two special legislative sessions, Alabama lawmakers passed a state budget Wednesday night that will cost taxpayers $86 million. With less than two weeks to spare before the start of the new fiscal year, Gov. Robert Bentley signed the $166 million budget into law on Thursday.

Despite GOP majorities in the House and Senate and Republican control of the governor's office, Alabama lawmakers were never able to reach a consensus in terms of where to make the necessary cuts to state funding in order to balance the budget. Unfortunately, even after the regular session and two special legislative sessions, House Republicans seemed to have given up all hope of cutting spending or reaching an agreement on how best to create revenues without raising taxes.

Instead of cutting spending or finding ways to create revenue, House Republicans, chose to raise taxes. In a very uncharacteristic display of legislative action, Republicans began introducing and passing a blitz of tax increase after tax increase after tax increase in a single afternoon last week. By the end of the day, House Republicans had enacted tax increases that totaled more than $130 million in new taxes without batting an eye.. Many of the new taxes were DOA (dead on arrival) the moment they went before the more conservative, entrenched Senate and did not survive. In addition to killing all but three of the tax bills, Senate leadership made the decision to transfer $80 million state funds from use tax revenues from the Education Trust Fund to the General Fund to avoid even more taxes on the people of Alabama.

In total, lawmakers approved about $166 million in new revenue to fund the budget that was signed by Gov. Bentley on Thursday. About $70 million a year of the $166 million General Fund Budget will be generated by a measure that increases the tax on cigarettes by 25 cents a pack. In addition to the tax on tobacco, new taxes on pharmacies and nursing homes will generate a total of about $16 million a year that will be allocated for Medicaid. And again, the remaining $80 million of the $166 million will be added to the budget after being transferred into the General Fund Budget.